from Jan Griesel

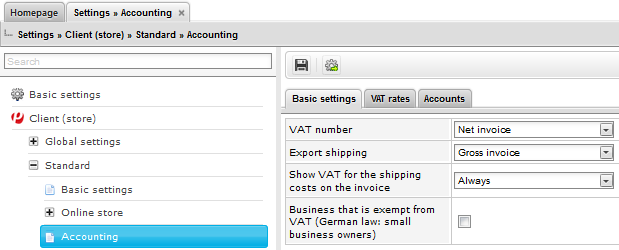

We have improved the accounting area for the newest release of plentymarkets version 5.1. All of the accounting settings, i.e. basic settings, VAT rates and accounts, can now be saved separately for each client (store). The new accounting menu is found under Settings » Client (store) » Standard » Accounting.

What do I need to know about the migration?

The current accounting settings will be applied to all of the existing clients (stores) during the migration. This means that all clients will have the same settings at first. Client-specific settings need to be saved manually after the migration.

Also new: Applying client-specific settings

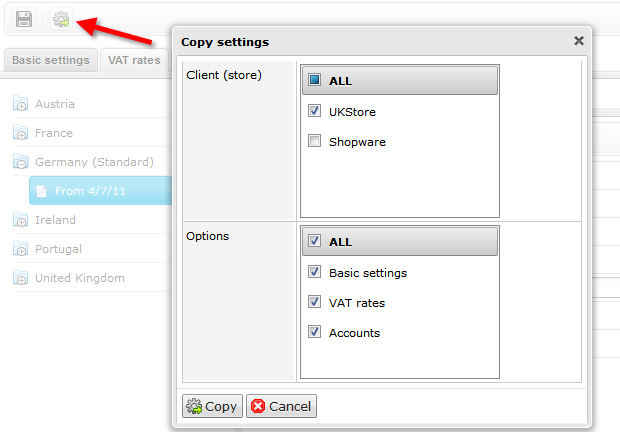

The new accounting module also allows you to copy settings form one client to another. You can either copy the settings of individual areas or the entire accounting settings from one client. This way you can easily apply changes to other clients once you have edited the settings for one client. This not only saves you time and energy, but it also helps you avoid careless errors when repeatedly configuring the same settings.

Client-specific data export

Since it is now possible to customize the accounting settings for each client, we have also made changes to the data export formats Collmex accounting, Financial accounting and Syska EURO FIBU. Data can now be exported for a specific client. You can export the data of one or several clients (stores) simultaneously.

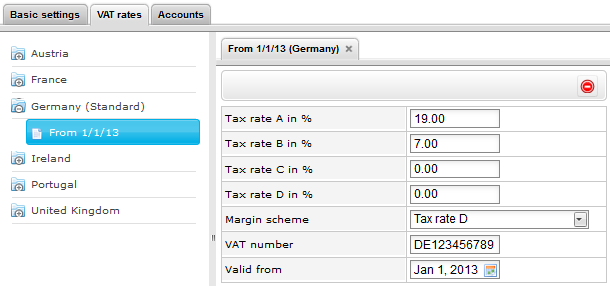

Also: More flexibility with the VAT rates

You can now save multiple VAT rates for a country of delivery in each client (store). Use the starting date to specify exactly when these VAT rates are valid. In the past, you could specify the delivery thresholds for each country of delivery. Now you can also be prepared whenever a specific country plans to change their VAT rates.

If a client reaches the delivery threshold for a specific country, then you can configure the valid VAT rates for this client only. In a later version, you will also automatically be reminded whenever you reach a delivery threshold. This will help you be proactive. Currently, you have to use the statistics module to check if a delivery threshold was reached.

Why should I specify a date?

Generally speaking, you can change the current VAT rate when you reach a delivery threshold. Future invoices will then be generated with the new VAT rates. However, some situations are a bit more complicated. For example, let's assume that you reached the delivery threshold for Austria on November 1st, 2014. Now it is November 2nd, 2014 and you want to correct an invoice from October 31st, 2014. This invoice needs to be generated with the VAT rates that were valid on October 31st, 2014.

It surely won't be long until you have to make adjustments again. You can now save the VAT rates in advance and specify when they will go into effect. This means that you will not have to revise the VAT rates at the exact moment when they change.

For further information about the Accounting menu, refer to the Accounting page of the manual.